.

ACTUARIAL

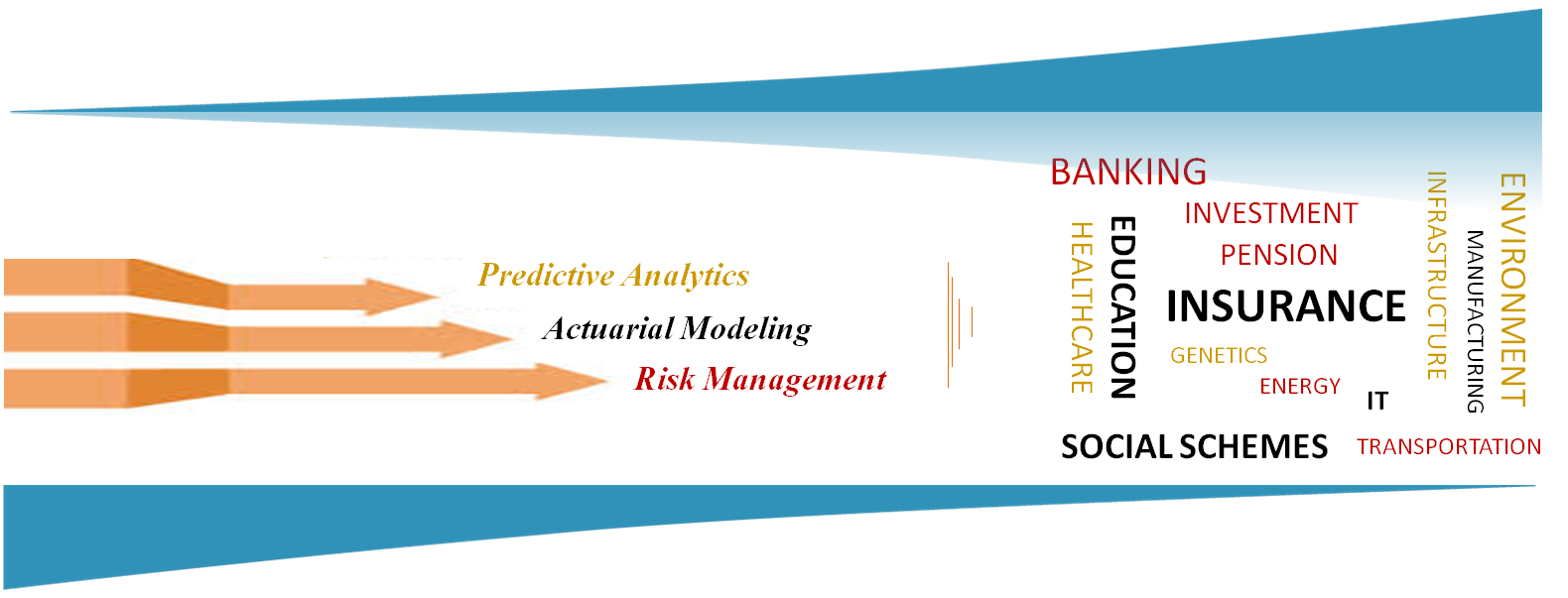

♦ GAP ANALYSIS - Risk and Capital Modeling

Need for our consultancy

The recent volatility in the capital markets and the consequent adverse developments across the financial services industry has stimulated interest in more sophisticated risk-management techniques. We believe that pricing and valuation of life insurance and annuity products are fundamentally exposed to the failure of adequately understanding of the risks that are assumed in estimations. Such lack of understanding results in pricing products incorrectly and over/under estimating the reserve to generate misleading reports in the balance sheet. We are valuable for insurers implementing conventional methodologies in risk management or facing shortage of actuarial expertise for high level of experience studies.

How our consultancy addressing the above issues

We assist life and health insurers in developing valuable insights about how their business performs, enabling them to target the right markets, develop better products, price more precisely, select profitable business, and optimize capital.

We develop a practical alternative to conventional methodologies used in insured experiences studies. A unique and important benefit of our model is its flexible applications and straightforward parameter interpretation. It tests the statistical significance of risk drivers in explaining mortality / morbidity differentiation, policyholders' behavior etc. It simultaneously analyzes many risk drivers, such as issue age, policy duration, underwriting class, etc., by performing multivariate analysis and logistic regressions. It allows insurers to make better use of limited amounts of data to derive more credible and normalized differentials. When model-estimated business (mix & volume), mortality and lapse are used as future projections for pricing or underwriting, it becomes a prediction for risks and capital. The benefits of employing our models do not come without challenges. Critical to superior model development is the requirement for copious amounts of data, specialized statistical modeling expertise, and in-depth business knowledge.

Our Methodology in Brief

We prepare insurance company specific standard tables of business growth (mix & volume) and demographic assumptions e.g. mortality / morbidity and lapses / renewals to perform the Gap Analysis and free capital accumulations. We apply predictive analytics, multivariate modeling and actuarial projections using past experiences to project the new figures of assets, liabilities and capital (free and regulatory) unlike to traditional methods of estimations that uses the industry specific rates for best estimates. This helps the insurers to minimize the parametric errors to decide the accurate premiums reflecting the business more closely and making them more capital efficient in terms of relatively less margin for adverse deviations (MAD). We validate the premiums using new approach and its impact on the new business volumes, claim ratios, mix of the business, reserves, solvency ratio, MCEV and free capital.

For more information, please write us on info@icarmaa.com