.

Prosperity for Life Plan

Why the plan is developed?

As per a WHO report, more than 1.08 lacs of Indians are pushed to poverty everyday because of ill health, disability or untimely deaths of primary breadwinners. Around 47% of rural population and 31.5% of urban population takes loans and sale their assets to finance the hospital admissions, contingencies, burial/funeral expenses, rituals etc.

Barring few lacs of wealthy population and adequately insured population the remaining population is exposed to drastic changes in their lifestyles or poverty due to untimely death, disability or disease (3D). The families marginally above the poverty line may also be pushed below it. The impact gets compounded if death occurs after a prolonged illness since in that situation a family also incurs expenditure on treatment.

How our plan is addressing the above issues?

The objective of the plan is enabling the families to remain indifferent under any adverse circumstances arising due to death, disability or disease without any extra investment. The plan takes full responsibility of families to protect them from any adverse consequences due to any tragedy in their life. Under our supervision the families will be able to maintain the similar / better lifestyle in the events of any tragedies (if happened) in future and be able to meet their regular expenses and liabilities as before without any dependency on others. With us nobody will push to poverty under any state of affairs.

Features of Plan

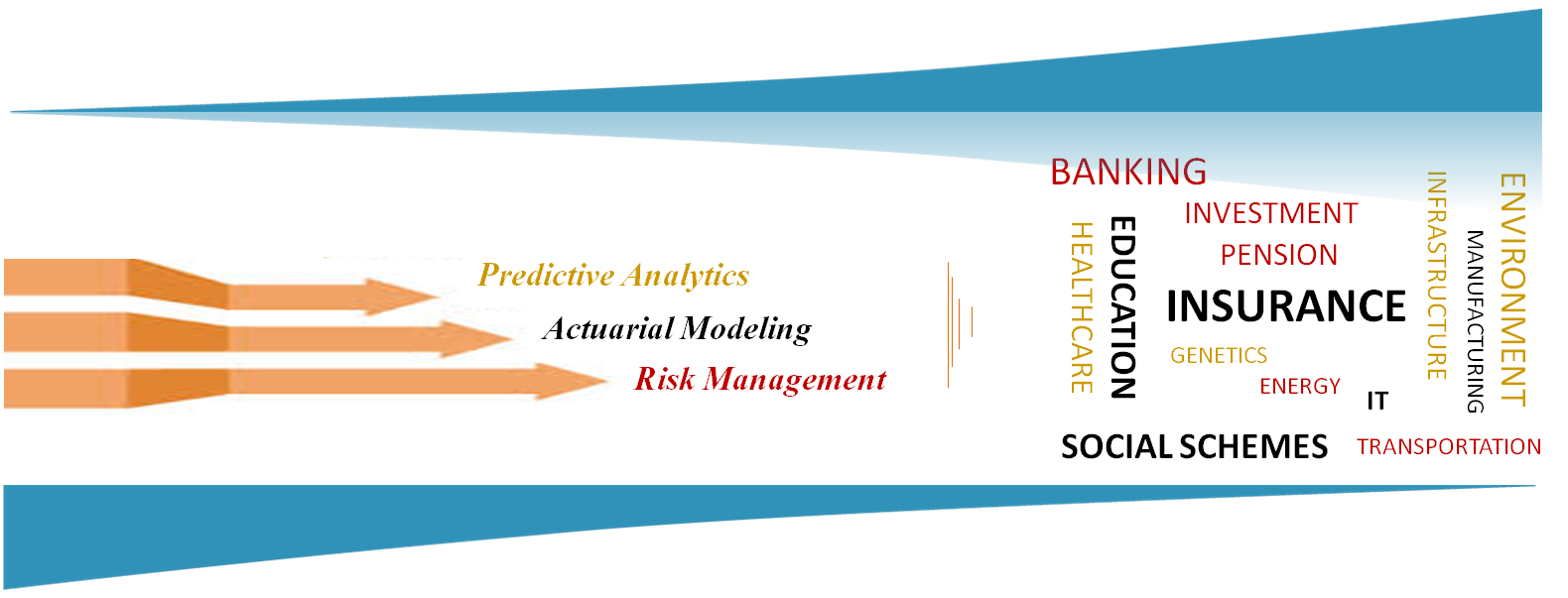

Our plan is designed to lead prosperity and happiness in individuals’ lives forever. This is an innovation in the field of Insurance diagnosis and advisory services where our Actuarial professionals (who design and set premiums of Insurance plans) design family specific plan to protect them from any dire consequences of future tragedies and secure their peace of mind without spending extra penny from their pocket.

We use our sophisticated Actuarial tools to underwrite the profiles of the primary members e.g. expected life time, future expenses, future liabilities, future health conditions etc to integrate with the real needs of the family.

The plan membership is free. Apply for your membership and secure your peace of mind forever.

Disclaimer

Almost every decision that you make affects someone's income, so how can you be sure that you are getting advice that is in your best interests rather than someone? We have no incentive to downplay risks or to avoid discussing a better alternative and we have no financial incentive to convince you to do something.

Actuaries are the only professionals who design the insurance plans and decide the premiums. They better understand and calculate the financial impacts on your premiums due to several financial and product specific differences by using their advanced actuarial techniques.

■ Consulting us could give you full peace of mind depending on which option you would have pursued in the absence of us.

■ We work only on behalf of the individual and therefore, no question of mis-selling or endorsing any specific plan arises.

■ All our opinions are unbiased as we have no tie ups with any insurance co. /brokers etc to earn commissions by selling their products.

■ Our analyses are not verbal and it is completely based on the advanced actuarial calculations and simulations.

■ Our services include the technical analysis of individual's financial and demographic conditions and to inform them the better options available.

■ We encourage individuals to buy their plans from the insurance co websites themselves and save their commissions.

■ We have no role in buying plans on someone's behalf.

For more information, please write us on info@icarmaa.com